Are You Ready to Take Your Franchise International?

Bringing your brand out of your home country and into a foreign country is a long-term strategic play. Just like most successful franchisors grew over time and built a strong base before they experienced strong and sometimes exponential growth, the best international plays should be rooted in patience, persistence, and knowledge.

Whether you are a US brand trying to expand outside of the country or a brand from another country looking to expand into the American market, our attorneys can help.

Meet Our Head of International Franchising: Victor Turcanu

Entry into the US Marketplace by Extranational Franchisors: The Basics

The United States offers a remarkable growth opportunity for franchisors from all over the world. The pursuit of this opportunity is, however, one that is often accompanied by significant business concerns.

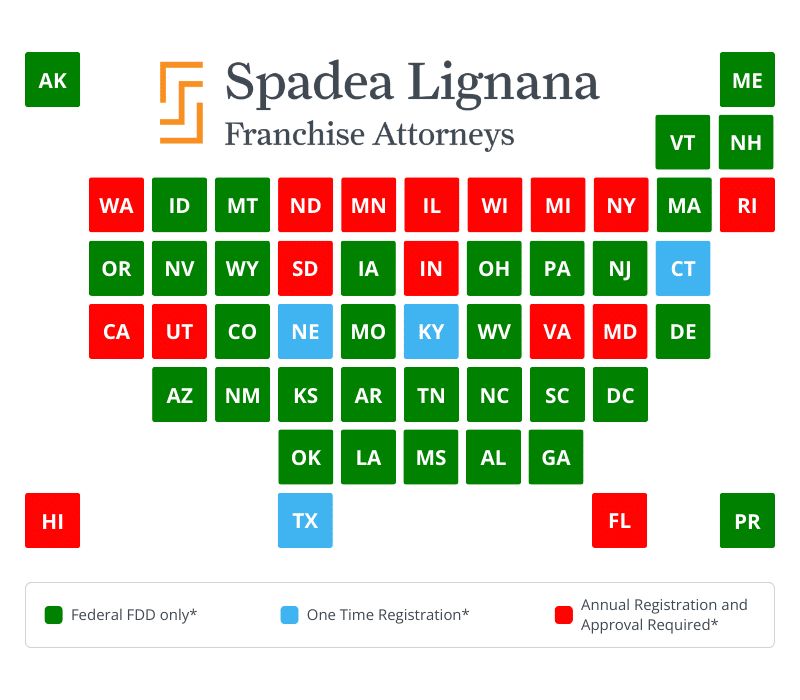

The United States is one of over thirty nations with laws specifically directed towards the regulation of the franchising business model. This country is not alone in recognizing the special considerations that arise from the franchisor/franchisee relationship. What separates our nation from others that regulate franchising, is that in addition to federal law, approximately 25 states have enacted registration, filing, and notice requirements. These regulations may seem intimidating and unnecessarily intrusive. The time and capital investment necessary to enter the U.S. market are perceived as prohibitive.

International franchisors are understandably concerned about:

- The complexities that arise from doing business in a singularly massive and diverse—or what some might consider fragmented—marketplace.

- Navigating through what may appear to be a morass of competing for Federal and State compliance regulations.

In actuality, while both of these concerns are legitimate, they are also far from insurmountable.

Under federal law, compliance obligations are very well defined, and not particularly complicated when measured against the franchise laws of other countries. Federal laws on franchising are under the purview of the U.S. Federal Trade Commission (“FTC”). There is no filing or registration required of a franchisor under the FTC’s rules.

State Registrations

Fifteen states (commonly referred to as “registration states”) have enacted laws that apply to the offer of franchises. Generally, these laws apply when a franchised location will be operated in a particular registration state, or the prospective franchisee lives in the registration state. Registration states add their own substantially similar pre-sale requirements to the FTC Rule’s pre-sale disclosure obligations. These laws range from requiring the filing of an annual notice to an exacting review of a franchise registration application and a renewal registration application on an annual basis. The registration states are California, Hawaii, Illinois, Indiana, Maryland, Minnesota, New York, North Dakota, Oregon, Rhode Island, South Dakota, Virginia, Washington, and Wisconsin.

Sixteen states have passed “relationship laws” focused on the rights of franchisees in existing franchise relationships. There are also other state statutes, in these and other states, that address specific industries, such as petroleum distributors, automobile dealerships, farm equipment dealers, and alcoholic beverage distributorships. These industry-specific laws will not be of any concern to the vast majority of franchisors seeking to sell franchises in the United States.

Tips for Bringing Your Franchise to America

The business diligence that an extranational franchisor must undertake before rolling out a franchising program in the United States, is substantially similar to the diligence required before entering any of the other thirty or so nations that have adopted franchise laws. The adoption of best practices should be a given, regardless of the market to be entered. Best practices may include:

- Determining what changes to your established franchise offering process will be required for effective market entry. This includes modification of operations manuals and pre-opening training requirements.

- Setting realistic expectations for projected profitability in a realistic timeframe.

- Devising an effective means of monitoring system requirements.

- Carefully calculate supply chain and distribution costs, including the impact of shipping, VAT, and duties.

- Examine development costs, seasonal, pricing, and U.S.-specific promotional campaigns.

- Determine what type of franchise operators can best execute your strategy. These include conversion franchisees, multi-unit developers, master franchisees, sub-franchisors, and development agents.

- Develop models for the financial performance of your franchise system in the U.S.

- Evaluate the sustainability of alternative channels of distribution.

- Be aware of the practical considerations that will arise from U.S. expansion, and determine how much of your franchisee training and support can be utilized.

- Consider opening a franchisor-owned U.S. location. This is certainly not a necessity but is an effective method of testing a U.S. market, without the need to immediately consider franchise regulations.

- Review your action steps with U.S. franchise counsel, including registration of your trademarks, forming your franchisor entity, and preparing financial statements.

Keeping Your Franchise Compliant in the United States

Once approved to offer franchises in the United States, franchisors must update their FDDs and state registrations every year. The FTC requires franchisors to annually renew the Franchise Disclosure Document within 120 days after the franchisor’s fiscal year-end date; registration states have requirements that are much the same. Franchisors must update their FDDs quarterly when there have been “material changes” to the franchise offering. In registration states, if material changes are made to the FDD, amended registration filings are to be made.

Under federal and state laws, there are various exemptions that allow a franchisor to bypass registration and disclosure requirements. Some exemptions provide for exemption from registration and disclosure; others from registration only. Exemptions exist for high net worth franchisors, often utilized in tandem with industry experience related to the business offered by the franchisor; sophisticated franchisee exemptions, which are based on the franchisee’s net worth, experience, or investment; and fractional franchises which relate to arrangements in which the franchised business comprises a minority of the franchisee’s overall business. Extranational franchisors entering the U.S. market should be aware of these exemptions, but should not expect to rely on exemptions to drive growth efforts.

Similarly, franchisors entering the U.S. marketplace should be aware of, but not preoccupied by, the existence of U.S. business opportunity laws. Like franchise laws, business opportunity laws are broad in the transactions they cover. Their registration and disclosure requirements are generally less uniform across states than franchise laws. Business opportunity laws typically apply to offerings where there is a payment of a fee for products or services.

There are, of course, several additional regulatory nuances that arise from the interplay between federal and state franchise laws; but with careful planning, advice from franchise counsel, and appropriate market analysis, franchisors need not be daunted by federal or state regulations. The franchising model continues to thrive in the U.S. because of, not in spite of, this country’s regulatory environment.

International Franchising Resources

Why Should You Expand Your Franchise Internationally?

For many established franchise systems, international expansion represents a significant growth opportunity. We have a specialized team of franchise attorneys that support franchise systems with their international expansions, both into and out of the United States.

Bringing Your Brand Outside the United States

Bringing your brand outside of the United States can be the next logical step in the expansion of your franchise system; however, it is a different game than domestic franchising and should not be done without a clear understanding of the risks, pitfalls, and unique challenges.

Work With an International Franchise Lawyer

We have helped many brands launch master franchise agreement programs and have also negotiated master franchise agreements for clients wishing to be the masters of an international brand. As long-standing members of the International Franchise Association (IFA), we have forged deep relationships with many attorneys and business people from across the globe. We welcome having an initial consultation with you to discuss your project.