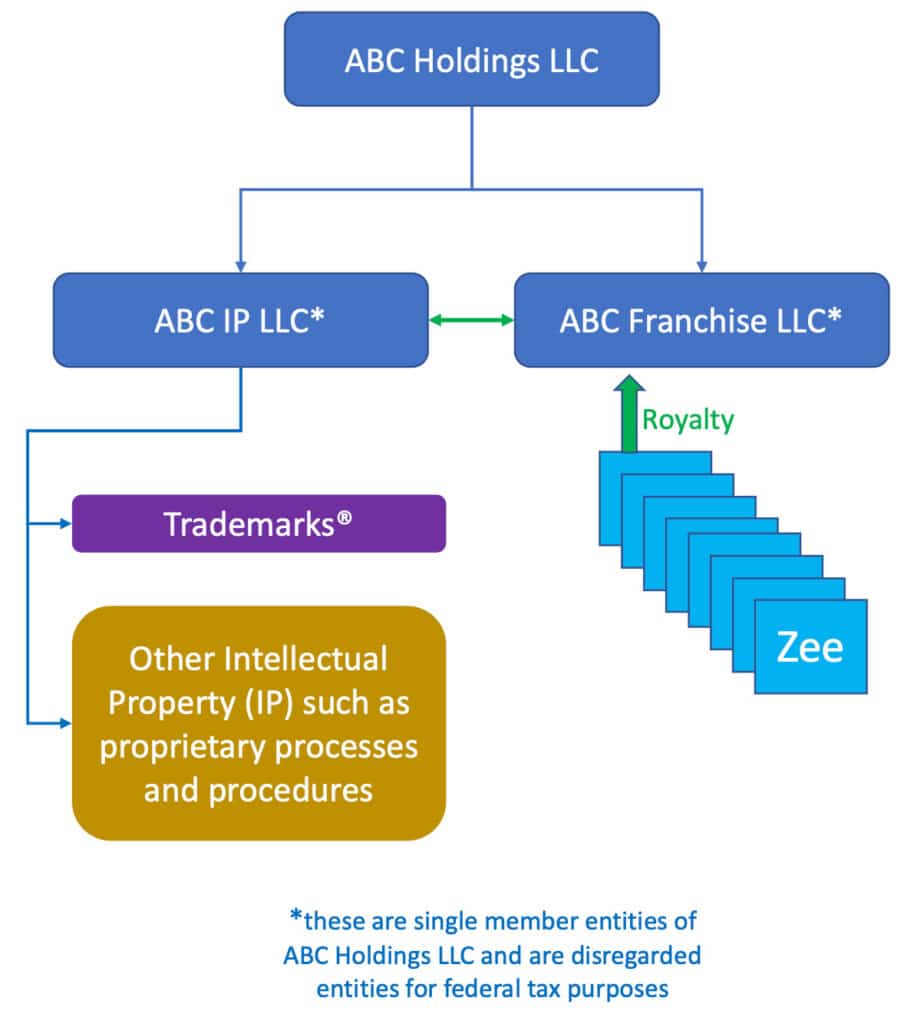

ABC Holdings LLC

- This is the main company that will file a tax return

- If there are multiple owners (such as outside investors or multiple founders/partners) it will require a more complex operating agreement documenting capital contributions, governance and distributions

- ABC Holdings will be the sole owner of the two subsidiary entities below

ABC IP LLC

- This is the intellectual property (IP) company that owns all trademarks and IP and licenses them to ABC Franchise LLC

- We will draft a simple 2 to 3 page standard licensing agreement to document the structure between the entities

- The operating agreement will be a simple single member operating agreement reflecting ABC Holdings as the sole owner

- This is a disregarded entity for tax purposes

ABC Franchise LLC

- This is the franchise company and the name on the FDD

- Will require audited financial statements

- Will be the entity that signs the Franchise Agreement with each franchisee

- The operating agreement will be a simple single member operating agreement reflecting ABC Holdings as the sole owner

- This is a disregarded entity for tax purposes

How to form the entities

These entities should be formed in the home state of the new Franchisor. This should be a discussion point with us, in the event you have multiple options you should choose a more franchisor friendly state to base your operation. Be sure to discuss this and any other questions you have related to the entity structure with us and your corporate attorney. If you aren’t currently working with a corporate attorney, we can certainly refer you to one that we have worked with in the past.

Each entity will require the owner’s legal name, one person’s social security number for the IRS to issue a Tax ID number and a non-PO Box street address.